Understanding the dynamics behind coffee prices is not just beneficial; it's essential for strategic sourcing, pricing, and planning. We want our customers to feel empowered with knowledge about why coffee prices fluctuate and what the future might hold for our prices at Foxen.

When you’re dealing with a global commodity like coffee, there’s ALWAYS some kind of geo-political, economic, or climate issue going on somewhere in the world that has an impact on the supply chain. So we prepare for this months, sometimes years ahead of time.

As of today, we are facing headwinds like 25%+ import tariffs and climate issues that could affect coffee prices globally. However, I want to assure you, WE ARE WAY AHEAD OF IT. We knew this was coming and we planned accordingly.

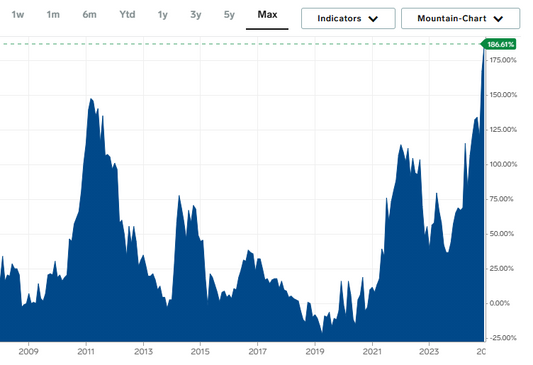

(this chart shows coffee spot prices from 2008 to current day)

While it’s true that import prices for coffee have increased a WHOPPING 180%+ SINCE 2019 lows,

You can rest assured that Foxen will not be suddenly raising prices on you without a plan. We believe we’re reaching a peak in the market, and global prices will make a correction over the next 2 years, so we’re going to hold our price as-is for as long as possible. However, in the unfortunate situation that prices never make this much-needed correction, we are in a position to raise prices gradually over many months or years, instead of abruptly and suddenly, so that we can ease the inflationary effects it has on our customers.

So let’s get into the details,

Why Do Coffee Prices Fluctuate?

Supply and Demand: At the core of coffee price fluctuations is the basic economic principle of supply and demand. Coffee, primarily grown in countries near the equator, can see its supply affected by numerous factors:

- Weather Conditions: Coffee plants are sensitive to climate. Frost, drought, or excessive rain can significantly impact yield, leading to price spikes if production drops. For instance, frost in Brazil, the world's largest coffee producer, can result in a sharp increase in prices globally due to reduced supply.

- Pest and Disease: Coffee Leaf Rust and other diseases can devastate crops, reducing supply and thus driving up prices. (back to the core fundamental of Supply & demand I referenced in the beginning)

- Global Market Dynamics: The coffee market isn't isolated; it's influenced by global economic trends, including currency fluctuations, especially since coffee is traded in US dollars. Coffee is the second most traded commodity in the world, just behind Crude Oil. So this market is watched and managed globally by millions of people.

Speculative Trading: The New York Coffee (NYC) market, where coffee futures are traded, plays a pivotal role in price determination. Speculative trading in these futures can cause significant price volatility. Traders might buy or sell futures based on predictions about future supply and demand, geopolitical events, or even perceived market sentiment.

We're betting on more stable market conditions into the future - wish us luck!

---

Author: Nicolas Milone, Co-Founder, Foxen Coffee